While Google is an obvious “horse to bet on,” ubiquity, UX and utility will dominate the voice-search innovation race in 2020 and beyond.

An old prediction that half of all internet searches will be carried out via voice by 2020 does not look like it’s on track to be a reality, despite making it into Mary Meeker’s Internet Trends 2016 Report.

Back then, in 2014, Baidu had just hired away Google Brain mastermind Andrew Ng to head up a massive deep learning project to help it beat Google in a new, non-text search race.

About five years later, China’s top search engine, Baidu, is still competing in the race to win in voice search dominance and secure the healthiest share of the lucrative market for voice commerce (v-commerce) that pundits predict lies ahead. In January during the annual C.E.S. show, Baidu said its answer to Alexa and Siri was already on 200 million devices. At that time, more than 100 million devices pre-installed with Alexa had been sold, and Google forecast it expected to have one billion devices with its Assistant onboard by the end of that month.

Just last month, a Harvard Business Review article by Bret Kinsella explored the race to own voice search and, in turn, the best v-commerce experience amongst the global tech giants:

“You can only understand the voice platform wars by first recognizing that voice assistants, specifically, represent both a platform and user interface (UI) shift comparable to the web and smartphones. This scenario both excites and frightens the leading tech companies that carved out enviable positions in the earlier web and smartphone platform wars.”

Google’s advantages and core challenge to winning voice search

Of the tech giants on our “home team” that are based in the U.S., Google seems like the most obvious company (versus Amazon, Microsoft or Apple) to bet on to eventually win and dominate in a new voice search age that powers v-commerce and corresponding ad dollars to support it.

For one, it currently owns more than 90 percent of all search traffic.

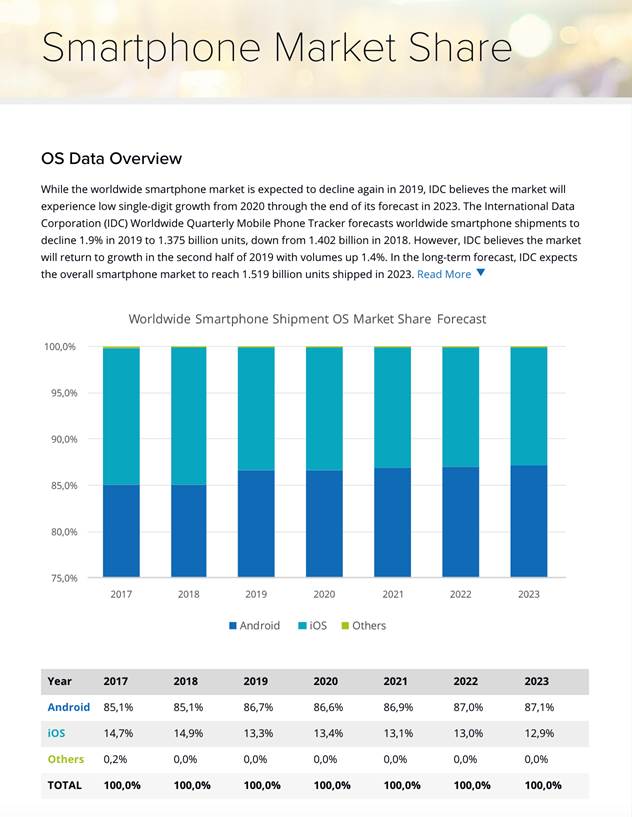

Its brand is synonymous with search today. “Just Google it,” as we all constantly say. Google’s ascendance as the dominant search engine sets it up well to be a similar authority and leader in voice search. Also, its Google Maps that is the go-to navigation app used by about 70 percent of smartphone owners, sets it up to help on-the-go users find and buy needed products nearby — from an umbrella in a rainstorm to the closest place to get some work done in a nearby internet cafe. When it comes to smartphones, Google’s Android OS continues to dominate the global market with about 86 percent of current market share compared to about 14 percent using Apple iOS, per the latest numbers from IDC.

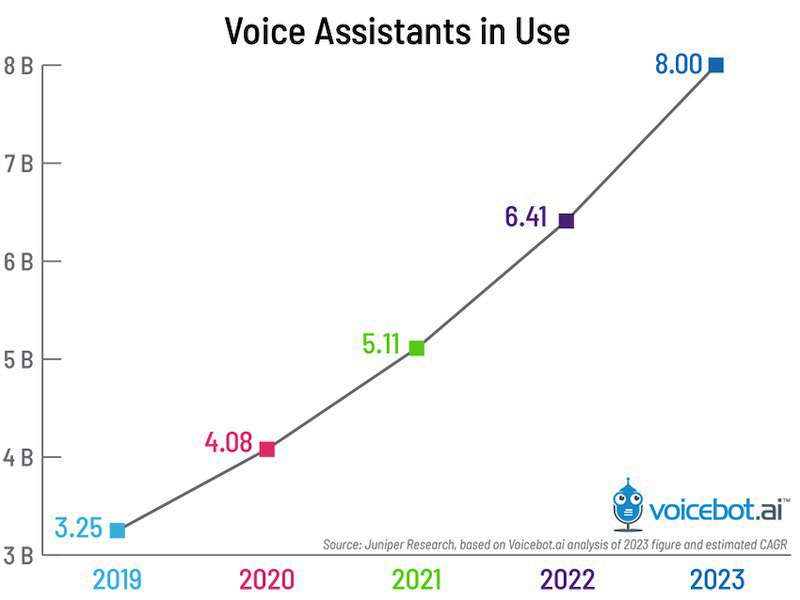

But, the future of voice search and v-commerce is not just all about smartphones. Juniper Research predicts there will be nearly eight billion digital voice assistants in use by 2023 compared to 1.5 billion assistance devices today.

The fastest growing category is connected TV-based voice assistants, and others will “live” in refrigerators, cars, smartwatches and more. The tech giants vying to own the future of v-commerce need to think about a ubiquitous presence across all types of smart devices that will be coming to market. Our virtual assistants are independent of smartphones or speakers. They can operate and serve us in many places.

It’s too early to rule out Amazon and Apple from winning the v-commerce race yet

In comparison to Google, both Amazon and Apple are less open in comparison. Both companies rely on walled gardens that provide distinct advantages and disadvantages.

For Apple, its focus on privacy for users has been popular with consumers and regulators, but when it comes to voice search paired with location-based marketing, Apple’s push to turn off access to location beacons in mobile apps via latest iOs 13 will limit how it plays in a world of v-commerce because its users won’t be able to ask their iPhone where the closest Starbucks is to them anymore. Apple’s approach also won’t lend itself to delivering a future of highly relevant, personalized offers that we’ve seen in future-forward SciFi movies such as “Minority Report.”

When it comes to eCommerce, no other player dominates like Amazon does today. Amazon has more than 80 percent of conversions compared to other eCommerce sites across a diverse set of product categories, according to Jumpshot. The planet’s largest retailer, a title that Amazon took from Walmart last month, has also surpassed Google in terms of where product searches start from on the internet. Yet, so far, Amazon has trailed behind Google in terms of an easy experience and accessibilty to bring users into a voice-activated world across devices.

Ubiquity across devices, the best UX and shopper utility will lead to dominance

The ultimate winner, in the end, will be the tech platform that delivers the ability to use voice search across the internet and the maximum number of devices. It’s also critical to deliver the simplicity of experience and speedy results that helped Google become the long-standing king of the hill for internet search with its first focus on text.

Google is doing its best to keep a step ahead in the emerging world of voice search that will enable a whole new way of controlling the online experience through our voices. That quality of experience and when voice search hits the mainstream will be driven, in large part, by the accuracy of voice recognition compared to actual human speech through advances in A.I. Two years ago, Google reached a threshold of understanding human language within 95 percent accuracy.

What promises to set Google apart, again, in voice search and give it a leg up in this very important innovation race, is the ability to create and consistently deliver a simple, elegant user experience that so far has held back consumer adoption and use of voice-powered assistants. It and Amazon both have a decent chance of converging voice-powered A.I. with a rich set of data on users that delivers the best, most personalized shopping experience.

Early on, many of the early adopters will use voice search that lead to the purchase of online items that are utilitarian in nature: such as “where can I find a late-night dinner spot that’s still open and nearby me,” or “what is the closest place to buy a laptop charger?” when you leave yours at the office during a business trip away from home. A whole new metrics category is also likely to emerge and differentiate which tech vendor(s) do it best. Perhaps we’ll measure effectiveness based on “vlicks” for voice-activated clicks as the market matures over time.

Whatever lays ahead in a brave new world of v-commerce powered by voice search, the ultimate winner(s) will be decided based on how they execute on ubiquity, UX and utility.

“On guard!” … and may the best voice search platform win. Who do you think it will be?

Gary Burtka is vice president of U.S. operations at RTB House, a global company that provides retargeting technology for global brands worldwide. Its North American headquarters are based in New York City.

Related reading

This is something I’ve been mulling over for a while. I threw the question out to SEO Twitter, and was surprised and impressed by the volume of responses.

Average position is misinterpreted as a metric that shows the actual position of ads on SERPs. How to accurately gauge the true page position of your ads?

SKAGs is the practice of placing single keywords in an ad group. With Google’s user intent evolution, is it still worth it?