Small business economic activity represents about 44% of U.S. gross domestic product. This critical business segment has suffered disproportionately from COVID-19’s toll on the economy. Now, as are in the all-important holiday quarter, what’s the current outlook for small businesses (SMBs)?

Many pundits and vendors serving the SMB market have been promoting and promising “resilience” for months. A new report from Yelp offers some support for this. But other data argue that challenges for SMBs and, by extension, their marketing providers will persist and may even intensify in the months ahead.

Hopeful signs of recovery

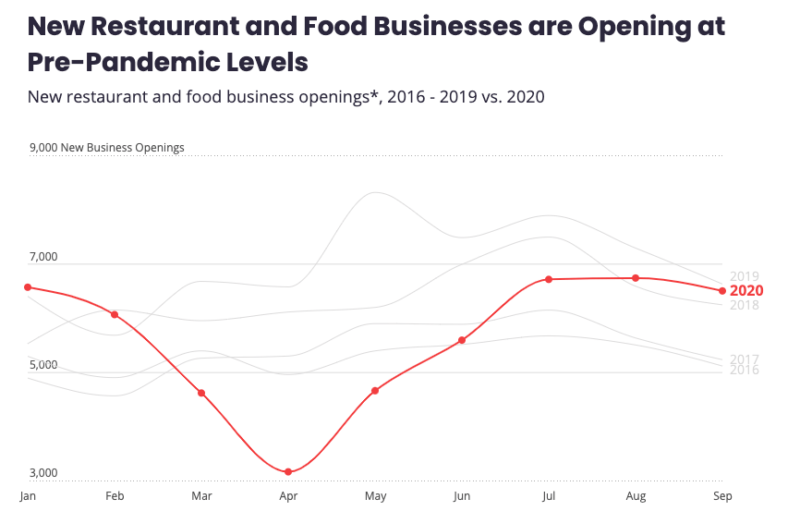

Yelp’s just-released Economic Average Report (or YEA) focuses on new business openings and reopenings during Q3 in the restaurant and food vertical. The report says that in Q3 new restaurant and food-business openings compared favorably to 2019 (“pre-pandemic levels”), despite the especially difficult circumstances of 2020.

That’s quite encouraging and argues a recovery is underway.

SMB openings and reopenings across verticals

Yelp also identifies the most “resilient” places in the U.S., as measured by growth in new business openings from Q2 to Q3. These were North Dakota, Washington, D.C., Rhode Island, New Hampshire and Wyoming. States with the largest number of business openings overall in Q3 were California, Texas, Florida, New York and Washington.

Yelp data reflect that businesses across a range of verticals also reopened in September. They include preschools and childcare centers, gyms, salons, bike repair shops and home services businesses. Financial services also reopened in Q3 (banks, insurance companies, tax services) as did retail stores, according to Yelp.

Simultaneously, Yelp observed increased consumer demand in Q3 across many categories as people “return[ed] to their pre-pandemic activities” — for better and for worse.

Vulnerable to safety concerns

As COVID cases in many states surge to their highest levels in months, concerned consumers may wind up spending most of their Q4 holiday dollars online and not in stores. Adobe data indicate that e-commerce sales growth has cooled as consumers head back to stores. But, store visitation is dependent on consumer perceptions of safety.

Read: What Prime Day signals for 2020 holiday retail

Right now, the majority of Americans still don’t feel safe in shopping malls — a surrogate for in-store shopping generally — though trends may vary somewhat by location. Unfortunately, we can’t expect anything significant to change before the end of the year. There are also multiple surveys suggesting that:

According to an early October consumer survey of more than 5,000 U.S. adults from Alignable, 32% of respondents said they would be spending more money at locally owned businesses in Q4. However, the large majority (68%) said they would be spending most of their money online this year (read: Amazon and big box retail).

This comes despite a number of surveys from firms like Accenture and McKinsey indicating heightened consumer interest in supporting small businesses and shopping locally. (Attitudes and behavior often diverge.)

U.S. Census Bureau survey data from mid-October shows that 75% of SMBs have seen a significant (30.2%) or moderate (44.6%) negative impact from COVID. More specifically, a Q3 SMB survey from Alignable found that “42% of small business owners anticipated revenues [in Q4] below what they needed to stay in business.”

That means if Q4 passes them by, vast numbers of SMBs could fail or decide to simply shut their doors in 2021.

What SMBs must do now to the meet the Q4 challenge

The internet will be the starting point for most consumer shopping journeys this holiday season, whether they conclude online or offline (BOPIS). That means a fully optimized online presence is critical. SMBs won’t be able to count on foot traffic and in-store browsing as much as in years past.

It’s too late to rebuild websites for holiday 2020. But SMBs can still claim and optimize profiles on a few key sites to maximize their online visibility:

All of these sites offer free online presence tools. However, most businesses have yet to take advantage of Nextdoor Business Pages and promotional tools so there are still “early mover” opportunities.

Read: Nextdoor emerges as a location marketing destination

Google has continued to add more transactional capabilities to GMB and Facebook and Instagram now offer SMB-friendly e-commerce capabilities with Shops and other features. In an ideal world SMB retailers would have their inventory online but, in the absence of that, key products and specials can be promoted through Google Posts.

SMBs working with agencies are fortunate and probably in a reasonable position to whether the storm. Those that are not, which is most smaller SMBs, are going to have a much tougher time. They should focus their efforts first and foremost on Google, which dominates local search usage.

There’s evidence that a Google-only strategy can succeed, if there isn’t time or bandwidth for other channels and properties.