Instagram wants to help luxury brands drive business goals. Image credit: Instagram

Instagram wants to help luxury brands drive business goals. Image credit: Instagram

Social networking giant Facebook Inc. is looking to make its ownership of subsidiaries Instagram and WhatsApp more apparent through a rebranding effort.

LinkedIn can be a very engaging channel, especially for B2B brands. Here’s everything you need to know about the recent changes in the algorithm and how to create engaging content.

LinkedIn has turned into the number one platform for professionals and B2B brands. It’s been a social media platform with a consistent mission and it is attracting millions of people and brands who want to focus on professional relationship building.

Just a few months ago, Microsoft announced that there has been ‘record levels of engagement’ on LinkedIn seeing a Q1 growth of 24% for on-platform sessions. It’s not surprising then that more brands are investing time in updating their LinkedIn strategy over the last few years.

A good way to understand how LinkedIn works and how to improve your engagement is to look at their algorithm and their recent updates.

LinkedIn has recently updated their algorithm that decides what shows up on our feeds. We might be talking more about Facebook’s algorithm when it comes to social media changes, but it’s still useful to understand how other platforms behave. When it comes to LinkedIn, what comes up on our feeds is based on their framework of ‘People You Know, Talking About Things You Care About.’

The most obvious posts that show up in your feed have to do with the people that you’re connected to or follow. There are also posts that your connections have liked, commented, shared that show up on your feed. Moreover, you can also see posts from groups, hashtags and topics that you follow.

The idea is to discover content that you care about. It’s not enough though to focus on relevance without the necessary value. The bigger the value, the higher the chances of seeing a post in your feed.

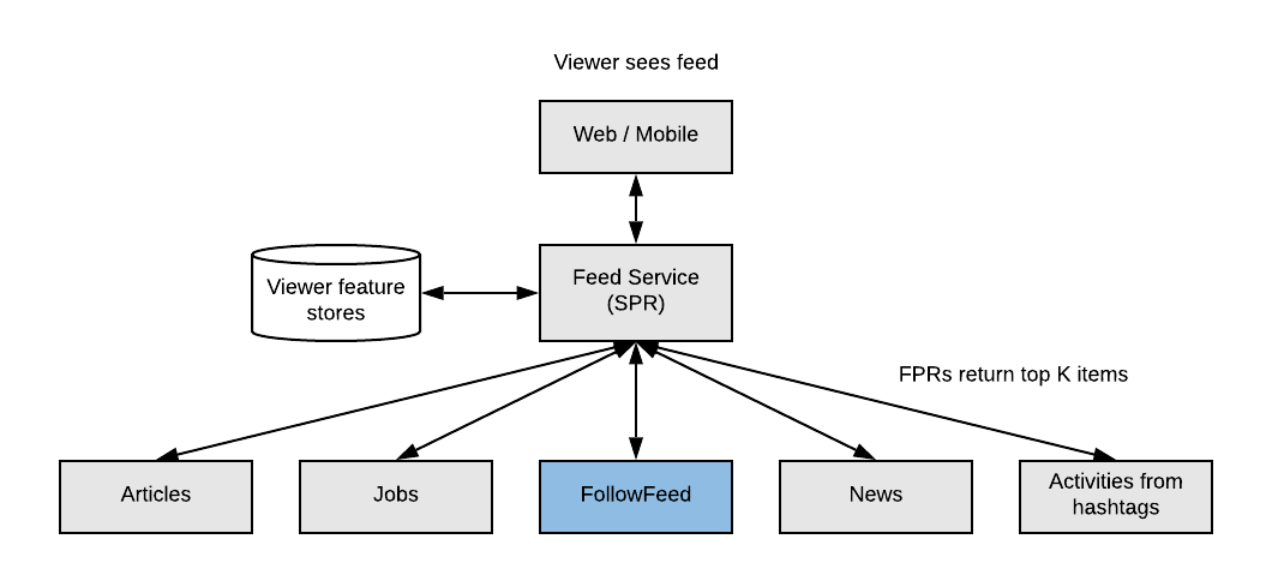

LinkedIn is relying on a machine learning algorithm that identifies the best conversations from all members that should show up to your feed. There is a two-pass architecture that ranks in the fraction of second thousands of posts to pick the most relevant ones for each member. The first pass rankers (FRP) are handling the preliminary selection that is based on predictive relevance (what they assume that you find relevant). For example, this selection can include updates from your connections, job ads and sponsored updates. The second pass ranker (SRP) combine all the preliminary scores to build a single list of ranking.

The FollowFeed is the main first pass ranker that brings tougher all the feed updates from your network and it includes more than 80% of your feed updates. In fact, these updates actually lead to more than 95% of the members’ conversations.

After an extensive series of tests and advanced machine learning features, LinkedIn is now focusing even more on the probability of contribution for the posts that show up on your feed. Thus, LinkedIn members see the content that they have more chances to share, comment, or react to.

To find out more technical details on LinkedIn’s algorithm, read their blog on their latest updates.

LinkedIn is aiming to encourage participation and the rise of engagement in the platform comes from a series of changes to their algorithm. As with Facebook, ‘meaningful interactions’ are important to ensure that users are exposed to the most engaging content.

From a brand perspective, it’s very important to keep up with these changes to ensure that you’re creating engaging content.

It’s crucial to encourage conversations to increase the chances of having your content show up in more feeds.

You can start building the engagement through a series of steps

Pete Davies, Consumer Product at LinkedIn, has written an article sharing his own tips on how to improve your LinkedIn content strategy to get your posts to show up on users’ feeds.

Some of his tips include:

Moreover, we also see more brands adding to their LinkedIn strategy:

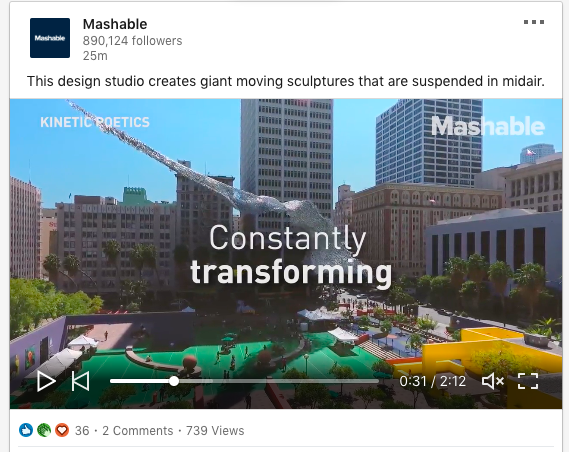

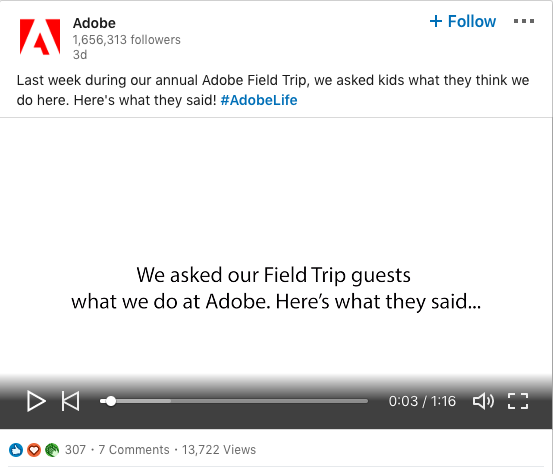

More brands are sharing videos and they tend to show up more frequently on our feeds over the last few months. Not all videos should be around campaigns, you can also share videos from your team, interesting interviews or even UGC that might be relevant.

There is a new trend on LinkedIn with posts that stand out with their creativity. How about sharing link posts that people won’t be able to ignore?

Hashtags have also had increased importance on LinkedIn especially when you want to improve your niche relevance.

When it comes to LinkedIn, what we need to remember when creating content is the reason why people are visiting the platform. People are visiting LinkedIn to connect with like-minded professionals. The content should be both interesting but also engaging to ensure that your brand stays relevant

Tactics to test within Google Ads if you want to expand your digital advertising strategy beyond keyword targeting, without venturing beyond Google.

There are only two broad strategies to improve your link building effectiveness, both of which come from a framework using BJ Fogg’s behavior model.

Five extensions that directly complement on-page SEO strategy, help rack-up rankings, track your website’s performance, and measure the core online metrics.

Today’s consumers have made mobile calls an integral part of their purchase journeys, as they seek more immediate gratification of their business information wants and needs. Phone calls provide deep-in-the-funnel prospects with fast answers, connections to real people and the type of detailed information that can play an important role in high-consideration purchases.

For marketers, inbound callers are proving to be highly engaged with brands, and convert more quickly than consumers that do not use the phone to interact with businesses. As a result, most digital marketers are stepping up their use of inbound calls as a marketing channel.

MarTech Today’s latest publication of the “Enterprise Call Analytics Platforms: A Marketer’s Guide” examines the market for call analytics platforms and the considerations involved in implementation. The 48-page report reviews the growing market for call analytics platforms, plus the latest trends, opportunities and challenges.

In this report you will learn:

Also included in the report are profiles of 13 leading enterprise call analytics vendors, capabilities comparisons and recommended steps for evaluating and purchasing. Visit Digital Marketing Depot to get your copy.

Once upon a time, Reddit was considered the “wild west” of the internet. The company’s CEO Steve Huffman described it as a “dystopian Craigslist” – a term he used to explain why the site underwent a major overhaul last year, rebuilding the platform from the ground up.

“The desktop website has not meaningfully changed in many years; it is not particularly welcoming to new users (or old for that matter); and still runs code from the earliest days of Reddit over 10 years ago,” said Huffman at the end of 2017 when Reddit announced its redesign plans.

It was this wild west environment that kept marketers at bay, not wanting to risk brand safety by putting ads on a platform with a less-than-welcoming reputation. But with the site’s overhaul, Reddit has rebuilt its platform to be more welcoming to users and, during the past year, rolled out several new advertising options for brands.

As part of our ongoing series focusing on the next era of social media marketing, we wanted to dig into Reddit’s ad opportunities since its redesign. Are brand safety concerns still an issue? Did Reddit’s “facelift” impact ad results? As the sixth most visited website in the U.S. (according to Alexa), is it time brands give more attention to Reddit? We turned to advertisers on the platform, along with the company’s VP of brand partnerships, to find answers.

“We’ve done a lot of heavy lifting to build a more sophisticated platform for both users and advertisers, and have been more proactive about having brand safety conversations with our partners,” said Zubair Jandali, Reddit’s Vice President of Brand Partnerships, “We have dedicated ads policy specialist with expertise in the space who has upped the cadence of our ad policy reviews and made refinements based on our assessment of the current environment.”

In June, Reddit announced a collaboration with Oracle Data Cloud, integrating Oracle’s Contextual Intelligence technology to provide advertisers brand safety controls for managing user-generated content in real-time.

Jandali said Reddit’s existing advertisers very rarely express brand safety concerns. “If a brand expresses concern about brand safety, explaining our layered approached to moderation tends to alleviate their concerns.”

Heather Cooan, the CEO of HDC Digital, has been running ad campaigns on Reddit for her clients intermittently since the platform launched, but more consistently during the last year. She says her clients have not had any brand safety concerns with Reddit.

“The advertisers I have on Reddit have a target audience that can be kind of cynical and are very security-minded and advertising averse,” said Cooan, “We have to hang out where they hang out. Brand safety is less of a concern.”

For Zachary Burt, the President of Code for Cash, a third-party recruiter of software engineers, Reddit’s tech-savvy communities offered a prime space to run ad campaigns aimed at driving traffic to the company’s job postings.

“The major issue is that if we leave comments enabled, people occasionally troll,” said Burt when asked if he’s experienced any brand safety issues on the platform, “We solved the problem by disabling comments on our ads. We found that the best ads are like text posts; sometimes instead of linking to our job application pages, offsite, we link to another Reddit thread where the applicants can enjoy authentic discussion with their peers, and then decide to apply.”

Duane Brown, the founder of Take Some Risk Inc., said his agency primarily ran sponsored text ads targeting niche sub-threads and hosted AMAs (Reddit’s “Ask Me Anything” subreddit threads involving a Q&A format) for the startups he worked with.

“Since we were targeting areas of Reddit that we felt were brand safe, we were comfortable running ads,” said Brown. His agency eventually stopped running Reddit campaigns – not because of brand safety issues, but instead because it simply was not getting strong enough ROI.

Burt said he targets software engineers on Reddit using the tech-specific subreddits along with the site’s geo-targeting capabilities.

“I can tell you that we are achieving cost-per-click rates that are about 50% lower than other channels for targeting our market of software developers,” said Burt, “This is actually typical with new PPC platforms — we saw the same with Quora ads as well.”

Cooan has also found success targeting very specific niche communities on Reddit.

“I tend to get a lot of clients that are in the industrial and technical verticals and I have found that Reddit is a place where their target audience – engineers and IT professionals – hang out,” said Cooan. Her target audience is often made up to people who don’t usually respond to advertising, so she uses messaging that is either super technical or sarcastic while still providing value.

“The key is the offer. These folks are very sensitive about what information they are willing to give,” said Cooan, “For example, they are not going to give their information to gain access to a whitepaper, but they will for a schematic.”

Jandali notes the importance of niche communities in terms of how Reddit’s layered approach to targeting works.

“We coach brands to start conversations where they’re hyper-relevant, extend that engagement to broader communities, and eventually rebroadcast the conversation to our largest communities,” said Jandali, “The key is staring the conversation in a niche community and moving ‘up-funnel’ once the content and tone has been established.”

A niche community goldmine.

Last year, Jandali told Marketing Land Reddit was seeing three to seven times better user engagement rates since the redesign. But, according to the advertisers we talked to, those lifts in user engagement have not impacted ad results. Cooan said she hasn’t noticed any major performance improvements with the redesign, but is happy with the direction Reddit has taken.

“It’s nice to be able to run multiple ad variations in a campaign to test messaging faster,” said Cooan, “I get the feeling the redesign was really about building a platform that would allow Reddit to scale development of the platform rather than an upgrade of features.”

Brown’s take on the redesign echoes Cooan’s thoughts.

“Could be our targeting, but we didn’t see a huge jump for our ads,” said Brown, “The new site is great and people on the team use it personally. People can still use the old site and revert back, so it’s hard to know how many people are really using the new site versus the old site.”

Burt also reported no difference in ad engagement for his Code For Cash ad campaigns. “The new platform is a little buggier, but I see the vision and like where they’re going,” said Burt.

Reddit reports it has 330 million monthly active users (MAUs) globally. To put that in perspective, Twitter reported 139 MAUs during the second quarter of this year and Pinterest just reported 300 million.

According to Alexa, Reddit has consistently ranked at the sixth most visited website in the U.S., with the daily time spent on the site at 10:14 – longer than the average time users spend on Google, YouTube, Facebook, Instagram or Twitter.

The site has also launched a number of new advertising options in the last year. Most recently, the company rolled out app install ads with third-party attribution options and tracking capabilities. In January, Reddit introduced its first performance-based ad unit with the launch of its cost-per-click ads. It also recruited Twitter’s former co-founder of performance ads business earlier this year, naming Shariq Rizvi Vice President of ad products and engineering.

Reddit may still have a ways to go in terms of what it can deliver for advertisers compared to Google, Facebook and Instagram. But, for brands aiming to connect with niche audiences, Reddit offers a unique opportunity — giving advertisers an alternative to social feeds saturated with ads.

Last week, we hosted another happy hour here at our New York office. This one was titled “Energizing Ecommerce: Retail winners, losers, and Amazon,” and was created in collaboration with Jumpshot. Here are highlights from the event around Amazon and Google, and their market shares in ecommerce.

Our speaker for the evening was Steve Kraus, Jumpshot’s Head of Digital Insights. Steve has been at Jumpshot since November 2018, and previously held roles including Chief of Insights at SimilarWeb and SVP and Chief Insights Officer at Ipsos. He did a PhD at Harvard in social psychology, and was also previously a professor.

He pulled on their data on consumer digital behavior to ask and answer various questions we all have about how consumers are searching and spending online.

Since they work with mostly clickstream data, the numbers in this article refer to desktop and mobile clicks, but exclude in-app actions. (You can read more about their data near the bottom of this article.)

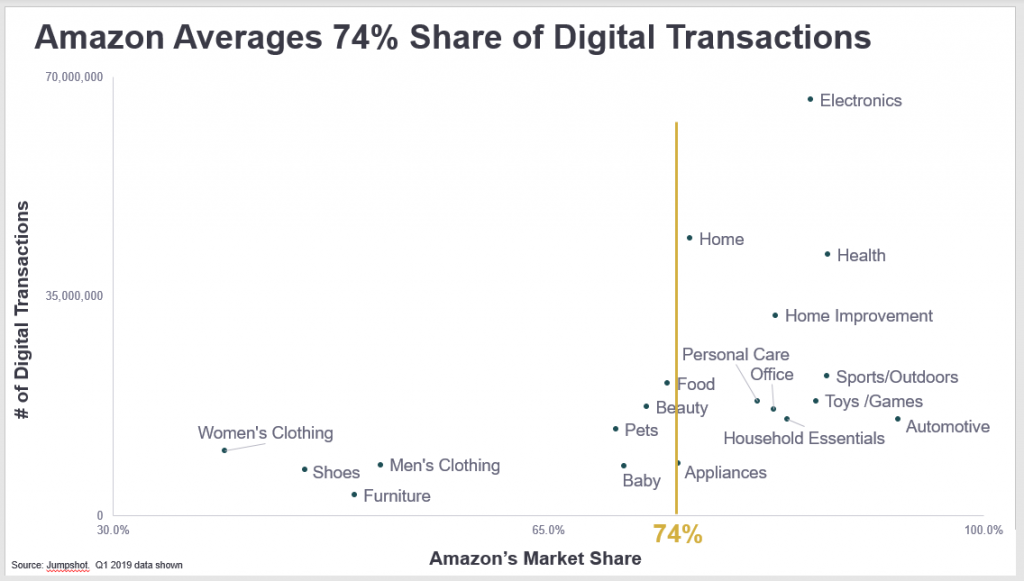

Steve jumped right in with a question we likely all have asked at one point: How much does Amazon matter in digital transactions?

Many in the audience guessed around a 35-60% share. But in reality, the distribution looks like this:

Amazon averages a 74% share of digital transactions in the US.

On this graph, the Y-axis represents the number of digital transactions and the X-axis shows Amazon’s market share in each. So for a category like electronics, you can see that there is a huge volume of digital transactions, and that Amazon holds maybe 80-85% of that volume. For something like women’s clothing, on the other other hand, both the volume is smaller and Amazon’s market share is smaller — closer to 35% (which we’ll expand on later).

Steve mentioned that it’s quite hard to capture every interaction in the long tail, but the numbers are still a fairly accurate representation of the overall.

The key takeaway?

“Everyone says Amazon is so big, but in reality many of us still underestimate them.”

According to Steve, people maybe aren’t over-hyping Amazon’s dominance (nor Google’s). And they may even be underestimating it.

“Many people guess Amazon’s market share at around 40-50% — but that’s how they perform in their worst categories, like clothing and furniture.”

He expanded on this point, adding that Amazon has 16x the number of transactions of Walmart, and 54x the number of transactions of Target.

“Even though we hear so much in the news about antitrust, Congressional hearings, etc., we still underestimate how big and powerful [these tech giants] really are.”

Another very popular question: How much of the search market does Google own?

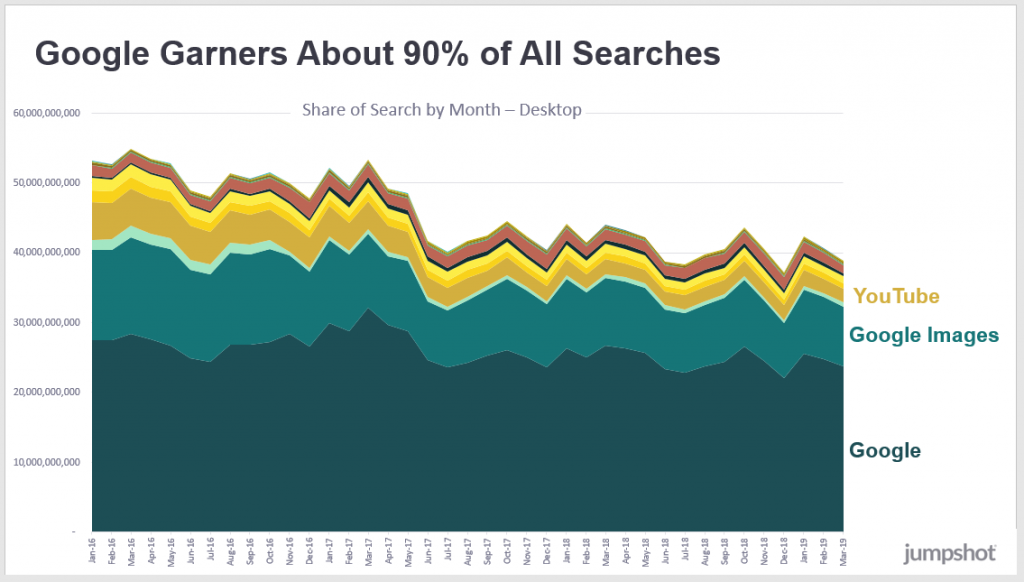

According to Jumpshot’s clickstream data, Google has about 90% of all web searches (desktop and Android phones).

The huge caveat here is that they can’t look at searches that happen via voice search nor inside an app — YouTube, Google Maps, Amazon and others all likely have huge volumes of search activity that’s not factored in. In the below graph, for instance, YouTube appears much smaller than Google Images, and we would assume that’s at least partly because most Google Image searchers use desktop and most YouTube searchers use the app.

We can also see from this graph how overall since January 2016, the volume of desktop searches is declining in all areas (and we would assume that volume is moving to mobile).

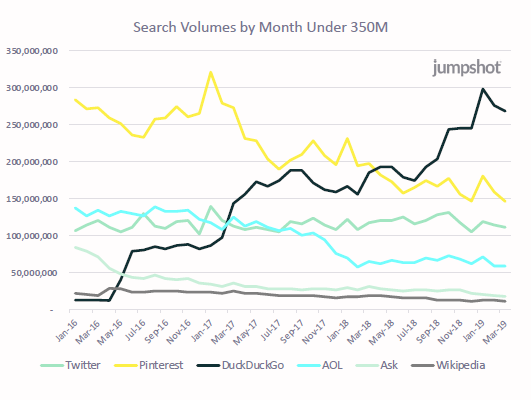

This graph shows the same data as above, but with Google removed so that we have a better view of the smaller players.

One interesting point to note here is how much DuckDuckGo is climbing. However, their overall volume remains quite small. They’ve gone from next to nothing up to 300 million searches a month, which is great. But compared to Google’s 60 billion searches a month, they hit just 0.5% of the volume.

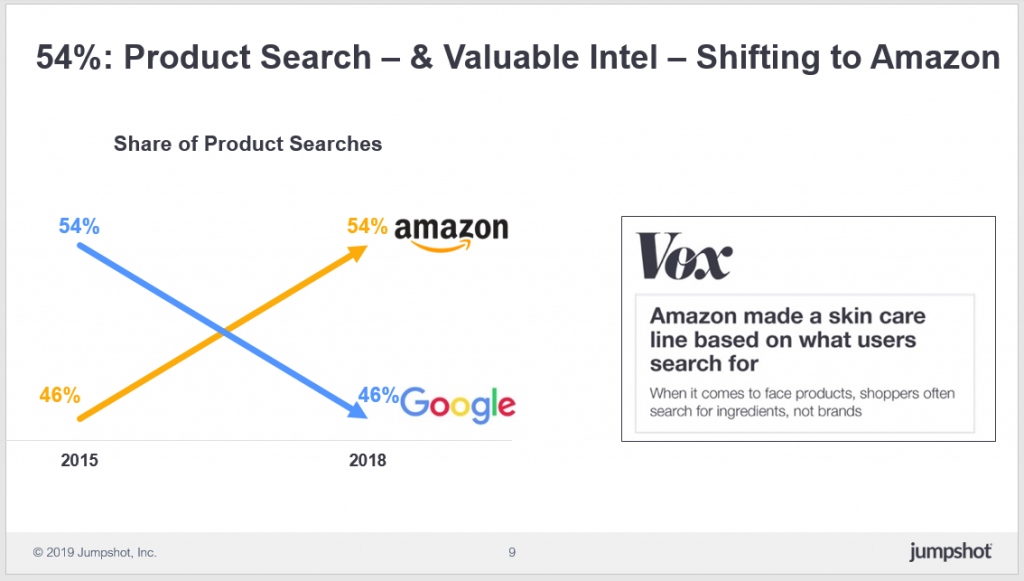

We’ve seen that Google owns the largest share of the search market. But what if we look specifically at product-related search?

Jumpshot found that the positions of Amazon and Google flipped between 2015 and 2018. As shown in the image below, in 2015, Google had 54% of product-related search and Amazon had 46%. In 2018, Amazon had jumped to 54% and Google had fallen to 46%.

The obvious concern here, and one that Steve demonstrated via the Vox headline, is the advantage that Amazon has from all the data collected in those searches. And of course, how little of that data is shared with sellers on Amazon who are made to compete with Amazon’s own product lines.

By simply investigating “What kinds of keywords are people searching for and not converting on?”, Amazon can discover opportunities in the market and fill them in a way their competition can’t.

The story here, “Amazon made a skin care line based on what users search for” represents an example of the qualms of many sellers, regulators, and consumers.

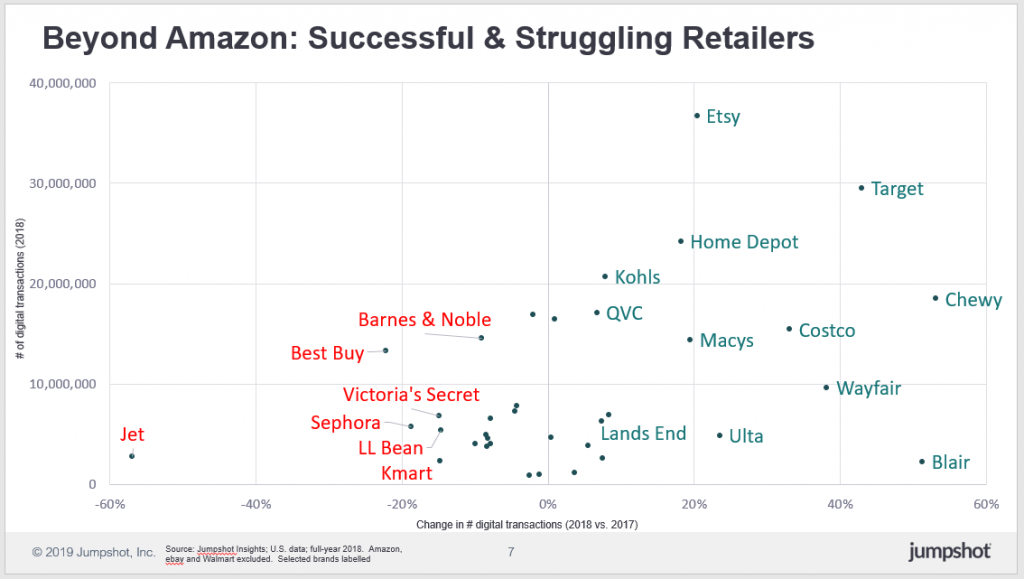

In the age of Amazon and Google, which retailers seem to be figuring out how to stay competitive?

Contrary to popular discourse about the “retail apocalypse,” Jumpshot says that many traditional brick-and-mortar retailers are doing quite well. Other, newer digital brands are, too — Chewy and Wayfair, for example.

In this chart, we see the distribution of a number of successful and struggling retailers. The y-axis represents the overall number of digital transactions of that brand in 2018, and the x-axis shows the change in their number of digital transactions between 2017 and 2018.

Any names shown in green, therefore, are growing their number of digital transactions. Brands in red are shrinking.

According to Steve, the retail apocalypse is a “story that’s oversold.”

On the contrary, he says that “a lot of brands known for their retail presence are figuring out omnichannel.”

What causes certain retailers to succeed while others don’t? According to Steve, part of the reason can be traced to the type of search happening: branded versus utilitarian.

There are two very different types of searches happening in the world, says Steve.

And as we might expect, Google and Amazon have very distinct roles in these two types of searches. In the graph below, we see search volumes for the top 1000 branded and non-branded keywords. Google’s volume lies on the y-axis and Amazon’s on the x-axis. Items in blue are branded searches, items in orange are unbranded searches.

Interestingly, both Prime Video and Audible get more search volume on Google than on Amazon (despite the fact that they’re owned by Amazon).

Terms like bluetooth headphones, hard drives, paper towels, and phone cases get very good volumes on both Amazon and Google.

Noteworthy here is that it’s difficult to distinguish whether or not some of these terms are product-related or knowledge-related. If someone searches for “iphone,” do they want to buy an iPhone, learn about the next iPhone to be released, or get help with the one they already have?

Steve also pointed out that furniture is another interesting category. Wayfair has had so much success in gaining search market share there. But a few years ago, we might have predicted it would be a category Amazon could have dominated: big ticket items where people don’t have strong brand preferences. Surprisingly, Amazon hasn’t done as well there.

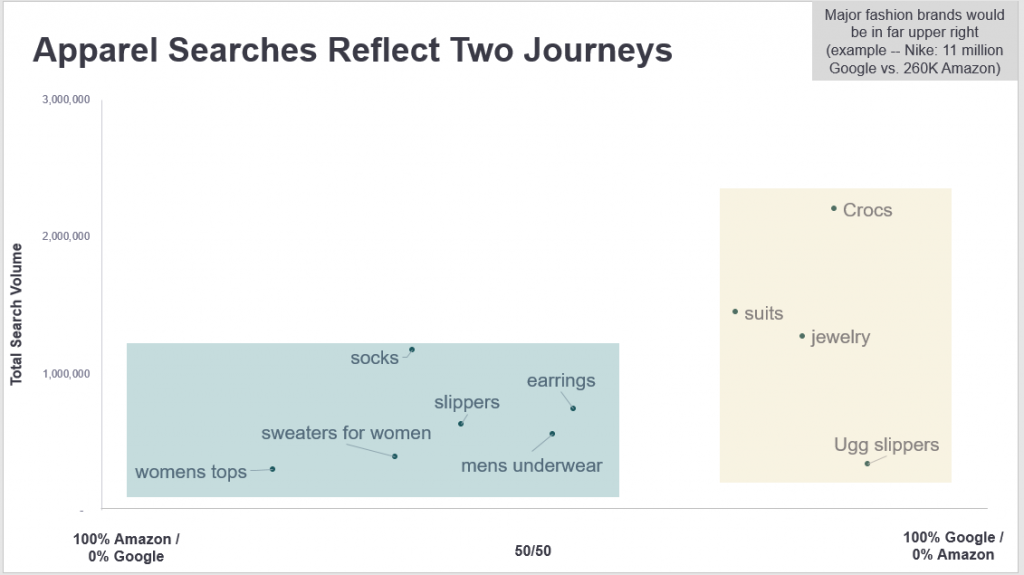

If we look specifically at apparel searches, we see they too tend to fall into either branded or utilitarian.

Amazon tends to do well on unbranded products like socks and underwear. Heinz for example might be highly successful on Amazon. Bigger, more well-known brands, on the other hand, tend to see higher traffic on Google.

In the image below, Jumpshot has noted that “major fashion brands would be in the far upper right.” For example, they say Nike has 11 million searches on Google versus just 250k on Amazon.

To be competitive in this context, Steve says one might ask themselves:

“What search terms are growing and not converting? That’s the real sweet spot of opportunity.”

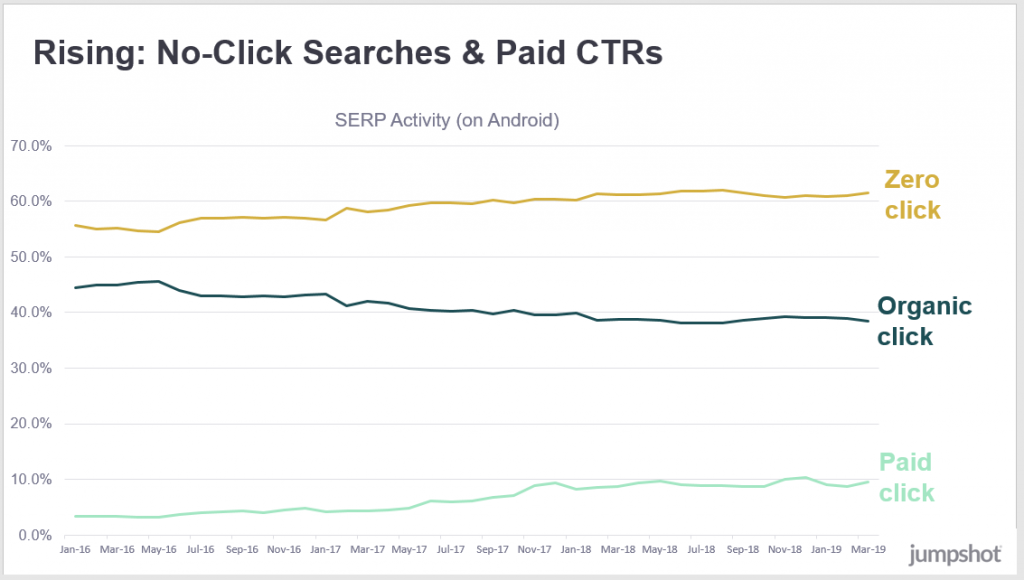

There are three possible actions after a search: organic clicks, paid clicks, or zero clicks.

Another question many of us are asking is, “Which of these, if any, is on the rise?”

In the graph below, we see trends of types of clicks from January 2016 to March 2019. Paid clicks and zero clicks are going up, and organic clicks are going down.

And of course, the whole idea of zero-click searches has a lot of people raising questions.

Similarly to Amazon, Google has extremely valuable data about searches. It’s arguably in their own business interest not to share it.

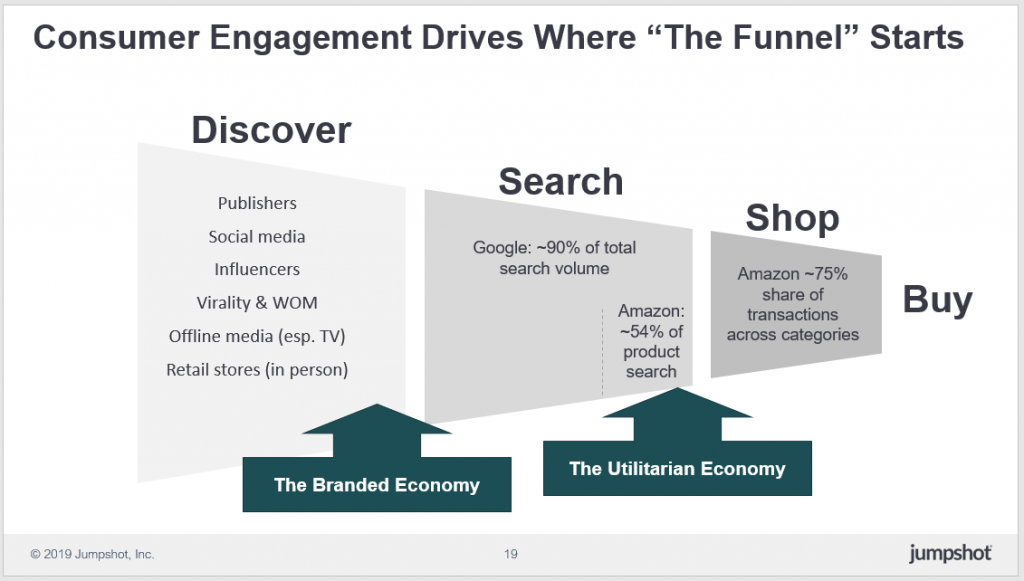

Discover –> search –> shop –> buy.

In this image, Jumpshot shows the consumer funnel and how Google and Amazon play dominant roles in the search and shop phases. Of the “search” category, Google has close to 90% of total search volume and Amazon has about 54% of product search volume. Of the “shop” category, Amazon has about a 75% share of transactions across categories.

Interestingly, though, the upper part of the funnel remains a bit more up for grabs. And as Steve points out, it’s a “very hard thing to quantify. We can quantify if you’re searching or shopping, but discovery has less immediate action.”

We might assume that sites like Facebook, Instagram, and Pinterest are where most of the discovery is happening. And while Facebook perhaps used to be very strong there, they’ve made changes to de-emphasize advertisers and move toward privacy.

At one point, an audience member asked Steve about his thoughts on regulation and privacy.

“My own suspicion is that here in the US it won’t happen anytime soon. In the EU yes, it’s already happening. But in the US, it almost seems “un-American” to talk about anti-trust. These are entrepreneurs. They made their own success. Why would we punish them? I don’t see the political will to do that here.”

At the same time, he noted that “you do see Facebook and Google preemptively stepping back from some things to stay out of the way.”

Jumpshot works with anonymized, aggregated, clickstream data from about 100 million devices, including desktop, mobile web for android, and app usage. (Note that their app data sits in a separate data set and doesn’t generally show what happens in an app. Rather, it shows if an app is opened, how many times it’s opened, and if a user clicked through to anything else.)

With clickstream data, Jumpshot can only look at what websites people have visited. They can model age and gender based on those websites, but overall their view is fairly high-level.

They also calibrate that data against “known sources of truth” such as actual versus predicted visits to a certain website. Based on those known sources of truth, they can develop algorithms to calibrate their numbers to those actual known numbers.

In general, Steve mentioned, their data is most accurate where they have more known sources of truth (such as in the US market).

We asked Steve what he found surprising or interesting about these findings, and he named: “in this world where Google and Amazon are so dominant, what does that mean for brands? How do they thrive? How do they make decision of utilitarian vs branded economy? They have to decide which one they’re going to play in. Some brands are strong enough that they’re able to do both.”

He elaborated with the example of Nike. They came out a couple years ago with a high-profile announcement that they would start selling directly on Amazon, which they hadn’t done previously.

Even if a brand isn’t directly selling on Amazon, the likely scenario is that they still have a presence there. Consumers can still go to Amazon, search for Nike, and get served results from resellers and wholesalers. Products may or may not be counterfeit, and sellers may or may not provide good service.

“A brand that’s not on Amazon is basically abdicating their presence on Amazon to lesser people, to these forces of the marketplace that they have no control over,” Steve says.

Nike wanted to have control over that, so they began a complex process of figuring out what and how they were going to sell on Amazon. They obviously wanted to keep their nike.com site, and they happen to be among brands who are strong enough to do so. So they started figuring out what consumers search for on their site versus on Amazon, and what products and prices to offer on each.

For retailers, Steve says, the question is:

“Do you want to work with Amazon, through Amazon, around Amazon? How do you thrive in this digital world where so many aspects of it are these winner-take-all markets?”

There are only two broad strategies to improve your link building effectiveness, both of which come from a framework using BJ Fogg’s behavior model.

An in-depth guide to call tracking technology that reviews how these tools help marketers connect digital campaign data to inbound customer phone calls.

Five extensions that directly complement on-page SEO strategy, help rack-up rankings, track your website’s performance, and measure the core online metrics.

Pinterest has released its second earnings report since going public in April, generating $261 million in revenue during the second quarter of this year — up 62% year-over-year, and nearly $60 million more than it earned during the first quarter of 2019. Of the $261 million it earned, $238 million came from the U.S.

The site’s monthly active users (MAUs) were also up, seeing a 30% increase year-over-year.

Despite the revenue gains, Pinterest reported a net loss of $1.16 billion for the quarter, which it says was impacted by, “RSU [restricted stock unit] expense recorded in connection with our initial public offering.” The company expects to surpass $1 billion in revenue, according to its full-year outlook for 2019, reaching between $1.095 billion and $1.115 billion.

Pinterest’s international reach. Pinterest’s global MAUs reached 300 million during the second quarter of the year, nine million more than it reported during the first quarter of the year. The bulk of Pinterest’s MAUs are international users: 215 million global MAUs compared to 85 million in the U.S.

Pinterest CFO Todd Morgenfeld said the company remains encouraged by the growth it is seeing in international markets. According to Pinterest’s second quarter earnings release, it is continuing to focus on improving user experiences to drive more growth and engagement: “During the quarter, we made Pinterest more personal by improving search recommendations, and we also made Pinterest more useful by adding more video content and shoppable products.”

More opportunities for advertisers. Pinterest CEO Ben Silbermann said said the company is continuing to “grow and diversify” its advertiser base and improve ad measurement capabilities for brands on the platform.

“This is part of our larger and ongoing effort to create value for businesses on Pinterest,” said Silbermann. During the second quarter of 2019, Pinterest introduced mobile ad tools that let advertisers create and manage campaigns from their phone, and launched new video capabilities for brands, including an updated video uploader, scheduling capabilities and a dedicated video tab within business profiles.

Pinterest is also focusing its efforts on e-commerce initiatives. Shortly before going public, the company recruited the head of Walmart’s e-commerce tech team, Jeremy King, to lead engineering. It has since launched the “Complete the Look” visual search tool — a feature that recommends relevant products based on the context of a scene.

Why we should care. As a discovery platform, Pinterest provides a wide range of opportunities to showcase products. Now that it is fine-tuning its e-commerce capabilities, the image-heavy social network is aiming to attract more retail brands and pull more ad dollars.

To be honest, paid search marketing is not a child’s play. Although its compelling benefits cannot be overemphasized, just like SEO, it has its own portion of disadvantages.

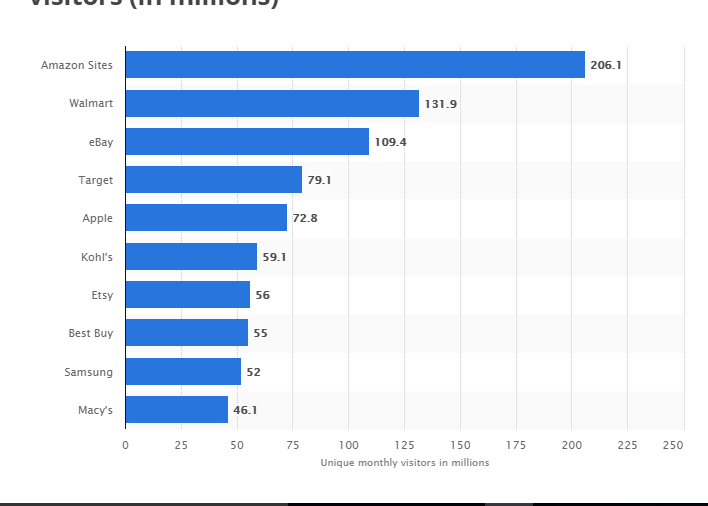

With no shortage of traffic, Amazon is no doubt a sure place to invest in paid search marketing. According to the research on the “most popular ecommerce websites in the U.S. as of December 2017”, Amazon ranked first with the average monthly users of about 197 million.

Source: Statista

Technically, you can still cut your own share of the cake even with a limited budget, provided you’re working with the right blueprint.

Of course, there are several methods of optimizing Amazon PPC, but here are blueprints on how to get the most out of it with a limited budget.

Source: Amazon

Focusing on your searchers intent and keywords that are relevant to the ad copy you serve is not just a strategy that will help you get the most out of Amazon PPC, but also a tactic to save more. As a result-driven seller with a limited budget, it’s crucial to have a rough idea of what your potential customers think. With this knowledge, you will be able to model the right keyword within the relevancy of what you sell on the Amazon platform.

Do you know that every visitor that visits Amazon’s ecommerce site is ready to buy one or more pieces of stuff from there? In fact, a new Survata study commissioned by BloomReach affirmed that about 50 percent of consumers kick-start their search on Amazon when they are looking to make a purchase.

That being the case, implementing this strategy will not only minimize the rate of irrelevant clicks, it will also boost your ROI by increasing positive CTR and landing more potential customers to your platform — since your keywords are pretty much in line with the searcher’s intent.

So, how do you figure out what keyword your potential customers use on Amazon search box to search for your product? The answer is — by using effective keyword tools.

As a matter of fact, getting the right keywords whether short or long-tailed is not impossible. Here are two tools that can help you find the most important keywords for your products on Amazon.

Source: Keyword Tool

As a result-driven Amazon seller with a limited budget, Keyword Tool is a great tool to work with. It will help you discover what searchers search for, and also reveal the long-tail and relevant keywords they use on Amazon.

Keyword Tool presents Amazon keywords in the exact same order as they were from the Amazon autocomplete. It also pulls estimated search volume data for the generated keywords. While you can get keyword suggestions for free even without creating an account here, you can also enjoy more additional data and functionality by subscribing to any custom plan that is within your budget range.

Source: Google Ads

Is it possible to know what keywords searchers use on Amazon with Google Keyword Planner? The answer is yes.

Actually, Google has a storehouse of collected data and with this tool — you can deduce how many searches a given phrase receives and also find other related phrases as well.

Here, you can also segment the collected data by any geographical location of choice which is very helpful for Amazon sellers selling on any Amazon site like Amazon.co.uk, Amazon.ca, and the others.

For the time being, it costs zero dollars to get a Google Keyword Planner. In fact, you do not have to create an active campaign. All you have to do is to create a free Google AdWords account. After that, you can find the Tools tab and click on the Keyword Planner.

This is one of the core parts sellers shy away from. Do you know that you can hit slacks if you’re not tweaking and continuously testing the effectiveness of your ad texts?

Clearly, your primary aim as a seller is to — boost sales, and leads. Whichever you’re paying for on Amazon, you need to constantly test the effectiveness of your ad text. As a matter of fact, If your ad text is not attention-grabbing and relevant to your listings, have it in mind that searchers won’t be clicking on it as expected.

Note: Breathtaking results don’t solely depend on how big your budget is, but on how wise you apportion your dollars.

Adding and monitoring your negative keyword list will help you save more money, especially when you’re building broader match types. Just like it sounds — pay-per-click, it’s very easy to throw away $$$ if you don’t perfectly understand the technical know-how.

When running on a limited budget, it is wise to take some necessary measures by adding the probable negative keywords. This prevents your Ads from being clicked by unbeneficial potential customers. More importantly, be very smart and cautious, so that you don’t block terms that are beneficial to your account.

Negative keywords are just like any other search words. It could be a long-tailed, short, phrase, or even exact match. And yes, when it comes to this, marketers — big or small budget, loses tons of money when searchers click on their product list without purchasing anything from their page. But the negative keywords setups are a practical shield primarily designed to minimize irrelevant clicks. Hence, it requires absolute wisdom to know which or which not to set up as negative keywords.

While the negative words help you to notify Adwords when to show up your ads, it is important that you know how to identify the right negative keywords to add to the list. Here are two ways to achieve this:

To begin with, create about eight to ten keywords that you’re advertising on, then go to Google and start searching them — one after the other. More importantly, when searching, look out for the following:

(i) Look out for what your competitors are advertising.

(ii) See if the results are related to what you search for.

(iii) If they are not, see “why” from the displayed result.

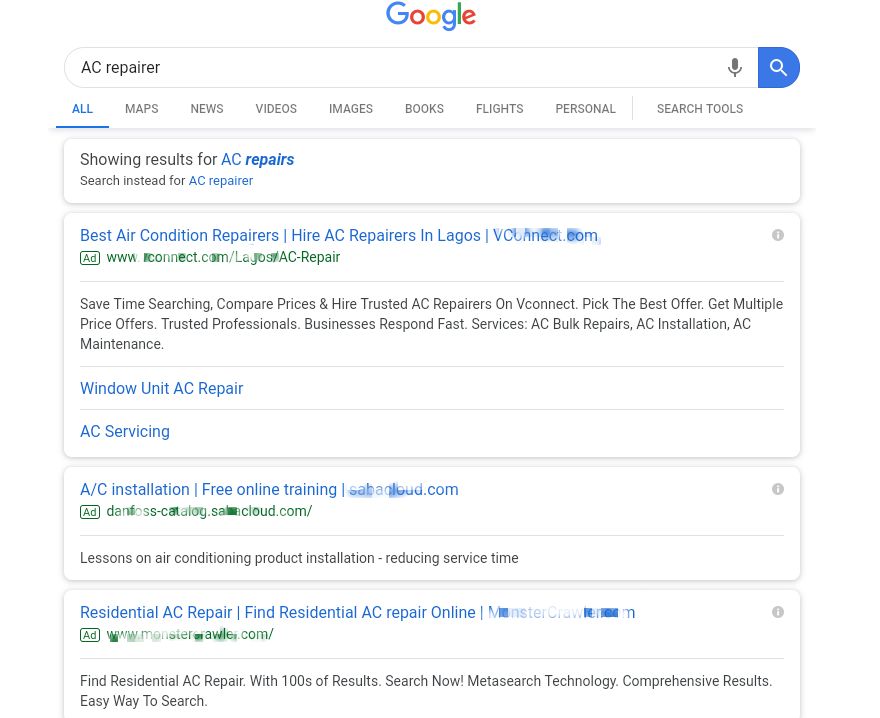

Let’s take, for instance, you searched for “AC repairer” and the following result came out:

Source: Google SERP

Say you’re an AC repairer contractor and you’re advertising your service on Amazon, you’ll observe from the result showing in the image above that one of the results isn’t related to your search term:

The second ad isn’t related because it’s about an expert who trains people on A/C installation online. An AC repairer contractor, in this case, doesn’t train a student on A/C installation. So, therefore, “Lesson on air conditioning product installation,” and its related terms are your sure negative keywords.

The first ad and the third ad informs us more about your service. So, adding the keywords you see like “Best Air Condition Repairers”, “Window Unit AC Repair”, “AC Servicing”, “Residential AC Repair”, and other like terms provides your ad with a better chance of being clicked by your target customers.

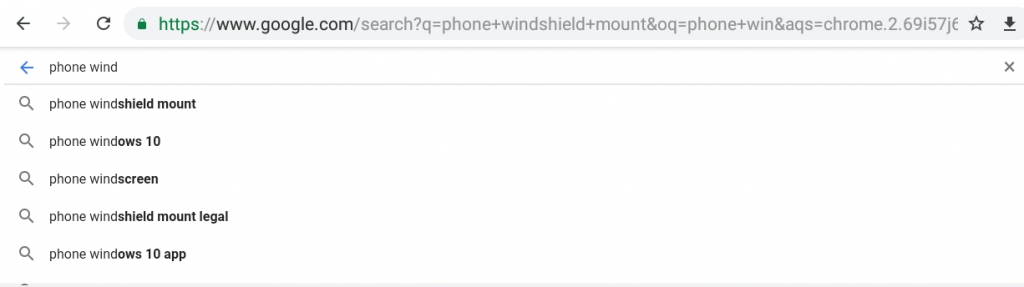

Source: Google

Here, every letter you add to the search box will technically change the auto-fill suggestions — simultaneously generating tons of possible ideas.

On the screenshot above, our “phone windshield mount seller” could also add “Windows 10 app” and “windows 10” to his negative keywords list.

Note: In the Amazon PPC campaign, you don’t have to spend, spend, and spend before you get a tangible ROI. In fact, all you need is to apportion your dollars rightly.

Francis Ejiofor is the Founder and CEO at EffectiveMarketingIdeas, a professional content marketing agency for startups and mid-sized businesses. He can be found on Twitter @anthony_ejiofor.

There are only two broad strategies to improve your link building effectiveness, both of which come from a framework using BJ Fogg’s behavior model.

Five extensions that directly complement on-page SEO strategy, help rack-up rankings, track your website’s performance, and measure the core online metrics.

It’s key to focus on one or two tests to ensure you reach statistical significance. Guide to testing ad copy, landing pages, new engines and ad formats.

CPG-focused ad metrics agency NCSolutions (NCS) announced on Thursday the launch of Sales Lift Metrics, a new in-flight campaign optimization service.

Driven by AI and machine learning technology, Sales Lift Metrics aims to deliver weekly incremental sales metrics that advertisers can use to inform and enhance campaign outcomes while they’re still active.

For programmatic campaigns, NCS said the service can help buyers optimize ad spend by tapping into real-time incremental sales metrics, allowing advertisers to dial-up or dial-down spend accordingly.

“CPG advertisers face urgent demands to reduce budget waste and optimize for sales outcomes,” said NCS EVP of strategy, Carl Spaulding. “Until now, their only options to improve results were to make changes post-campaign or rely on in-flight media performance metrics not directly related to offline sales. But with this innovative solution, advertisers can tap into near real-time insights and refine campaigns in-flight to improve outcomes.”

The Sales Lift Metrics service is designed to provide in-flight data on key campaign tactics, such as audience targets, media placements, creative messaging and ad formats.

Earlier this year, Adobe signed on as a pilot partner for Sales Lift Metrics to test its CPG campaign optimization methodology. According to a representative from Adobe, NCS’ in-flight solution has been able to deliver lucrative insights around the campaign tactics that drive incremental sales “on a much shorter latency than with existing industry solutions.” Adobe added, “With this knowledge, our CPG advertisers can make campaign decisions to gain and maximize incremental sales.”

“Near real-time visibility into the effectiveness of campaign tactics that are the primary drivers of incremental sales has long been a desired ideal for advertisers,” says Leslie Wood, chief research officer at NCS.

The ability to interpret real-time metrics on a tactical level means that advertisers can modify campaigns in-flight to produce more efficient and accurate outcomes. This could help cut down on ad spend while also presenting an opportunity to course-correct during the campaign’s lifetime.

For CPG marketers, in particular, understanding the immediate sales lift on a campaign-by-campaign basis can help build a more complete picture of the immediate market and inform future campaign strategies.

The payday loans industry continues to be a lucrative and popular sector in the UK.

With Google’s SERPs overwhelmed with black hat SEO and hacked sites, the search engine giant responded with a unique payday loans algorithm, which they have continued to develop and refine since 2013, as touched upon in the payday loans algorithm review from last year.

Never before had Google dedicated an entire algorithm to one particular product so openly, and at the time it was considered ground-breaking.

However, since my last piece, the industry has seen further challenges and changes and this has had a profound impact on the companies that rank and the type of search terms that we see.

Notably, the rise in compensation claims has seen the casualty of four of the UK’s largest lenders and this has opened up the market for other lenders and brokers to capture up to one million more leads that were previously unattainable. So getting to page one for “payday loans” is still very hot on the agenda for a lot of companies and new entrants.

The use of fresh content is important, as it is for most industries and services. Specifically, for payday loans, the use of quality landing pages (rather than a homepage) is more effective to rank for key terms. Across the top 20 search positions, only three are using their homepage to rank, with 17 using devoted landing pages which either use /payday-loans/, /payday-loans-uk/ or /payday-loans-alternative/.

Whilst mentioning the use of alternatives was very popular last year, this is now only mentioned in two meta-titles across the top 20 positions.

Similar to last year, there are still no comparison tables that are in the top search results, with the closest one on page three (all the lenders) and not even the dominant Money.co.uk featured anywhere in the top four pages. When compared to other products such as credit cards and car insurance, comparison tables are used in the majority of page one listings.

The lack of comparison tables is surprising, given the regulator’s encouragement for consumers to use more comparison sites in this space and for each lender, by law, to list at least one price comparison website (PCW) on their homepage.

With no comparison websites, the sites classed as ‘direct lenders’ continue to be the strongest ranking websites, hence many lenders are using this terminology in their meta-data, internal links, and content.

Google has clearly favored those sites with clear user intent and ability to find the product and apply for it in the same place, without having to leave. Direct lenders have used multiple calls-to-action on their landing pages and this is proving fruitful.

The payday loans algorithm continues to be heavily influenced by the use of links and link manipulation. Many sites ranking in the top five and top 10 for payday loans continue to use PBN networks and buying links with a mix of the brand match and exact match to multiple landing pages. Topped off with a regular monthly disavow file, this seems to be working well and consistently for various lenders who continue to stay on page one for more than two years.

Elsewhere, some new entries have come into the market by taking older domains with strong backlinks and not necessarily ones that are loans or finance related. The likes of Omacl, New Horizons, and CUJ have made huge strides in the last 12 months, from being virtually unknown and leveraging strong links in education, science, and technology – suggesting that Google also rewards links from different industries.

Elsewhere, for many direct lenders, they have benefitted by buying and selling leads from lead generation brokers such as Quint and have subsequently gained links in privacy policies and terms and conditions (even though no link is necessarily required) from numerous sites. This has given several lenders a huge boost in rankings and a much stronger trust score than other types of links.

The stricter requirements from the FCA has unsurprisingly led to fewer loans being funded and tougher circumstances for those with bad credit. This has increased the number of search volumes for bad credit terms, including bad credit loans (145,000 monthly searches) and other variations such as ‘payday loans for bad credit’ (40,500 monthly searches) and ‘payday loans no credit check’ (27,100 monthly searches) – in fact, some sites have been optimized specifically to target these terms such as bad credit site and payday bad credit.

Whilst trust signals such as about us pages, FAQs, and contact pages will always be useful across SEO, Google may be giving weight to other features such as calculators, forms and basic information.

Referring to Wonga.com, the former market leader, they had been dominating the top three positions for payday loans for over five years, but since going into administration in November and removing its calculator and basic loan information, today it is not even only the first 10 pages of Google.

Whilst only an urban myth, many SEO professionals will hint at the idea that Google is making manual changes and choosing to upgrade and demote various sites in the payday loans algorithm.

Following an algorithm change in March and June, we have seen some select sites gain huge improvements and some fall massively. This could just be the cyclical nature of algorithms and Google updates, or genuine attempts by Google to improve the quality of search results for potential payday loan customers.

Search results are cyclical and subject to algorithm updates.

Daniel Tannenbaum is the CEO of Guarantor Loan Comparison.

Five extensions that directly complement on-page SEO strategy, help rack-up rankings, track your website’s performance, and measure the core online metrics.

It’s key to focus on one or two tests to ensure you reach statistical significance. Guide to testing ad copy, landing pages, new engines and ad formats.

During its long history as a vital ranking factor, PageRank was surrounded by a multitude of misconceptions. Five of the most prevalent ones addressed.