Technology giant Apple is looking to conquer another category with the launch of its credit card in partnership with Goldman Sachs, in a move that is poised to extend its influence in the payments space.

Apple Card, which became available to select consumers in the United States on Aug. 6, is positioned as a digitally-driven alternative to bank-issued credit. With Apple’s loyal following, what does this move mean for upscale credit cards that similarly court the affluent?

“The company had already entered the market via Apple Pay,” said Jill Gonzalez, analyst at WalletHub, Washington, D.C. “Moving to credit cards seems like a natural development, and it basically makes a line of credit available for Apple Pay users.

“That’s because the card is best suited for those who use Apple Pay on a regular basis, as the rewards are highest when using this payment method,” she said. “It’s also worth noting that the Apple credit card issued by Goldman Sachs is not the first to hit the market, as Barclays also offers an Apple credit card.”

Ms. Gonzalez is not affiliated with Apple, but agreed to comment as an industry expert. Apple was reached for comment.

Credit extension

Apple Card is centered around the company’s iPhone, and consumers have to own a compatible version of the device to be eligible for the card.

Primarily, Apple Card operates through the iPhone’s Wallet application. At bricks-and-mortar stores, consumers can charge purchases on the virtual card through Apple Pay.

The digital card can also be used to make online purchases. When shopping on Apple’s browser Safari, the consumer’s Apple Card details will automatically populate.

Once approved, consumers can immediately begin to use the digital card. However, cardholders can request to have a titanium card sent to them if they wish. This card operates on Mastercard’s network, making it widely accepted.

One of the aspects that Apple emphasized in the design of Apple Card is simplicity.

Customer service is accessible via text message round the clock.

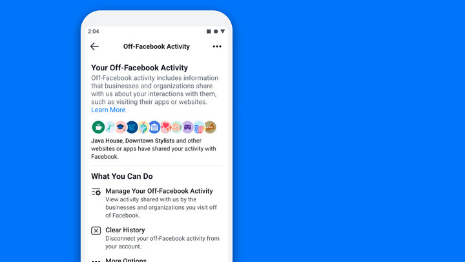

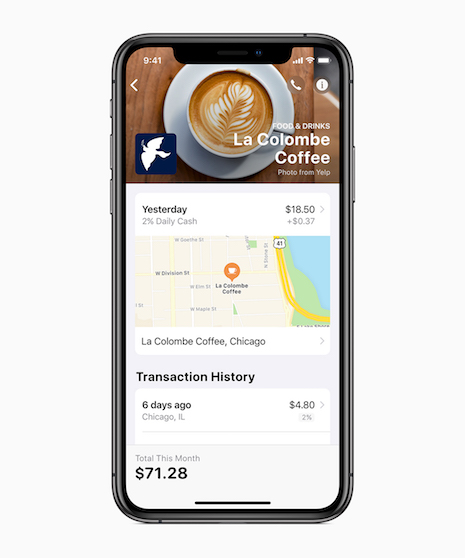

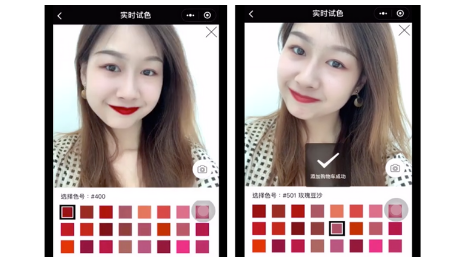

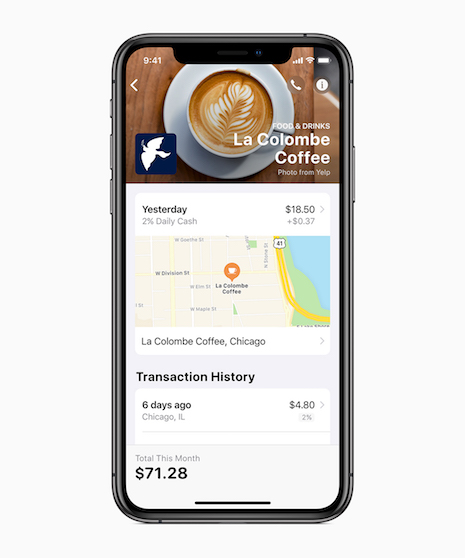

Apple will also use machine learning to more thoroughly describe transactions. Consumers can also pinpoint transactions on a map to jog their memory.

Apple Card will show consumers where they made purchases. Image courtesy of Apple

Cardholders earn a 2 percent cash bonus from every purchase, and a 3 percent bonus for purchases made via Apple’s stores, which is delivered each day rather than on a monthly basis. This bonus can be deposited into a bank account or used for purchases and other transactions.

Apple Card’s cash bonus is 1 percent for purchases made with the physical card, prompting consumers to use digital payments instead.

“The Apple Card joins an already crowded market full of cash-back cards,” said Sara Rathner, credit cards expert at NerdWallet, San Francisco.

“While cards offering 1.5 percent cash back on all purchases have become the baseline, Apple’s 2 percent cash back on purchases made with Apple Pay could nudge more cards in that direction,” she said. “Right now, the Citi Double Cash is one of the few no-fee cards offering 2 percent cash back on everything.”

This is not Apple’s first credit card rewards program. Previously, Apple had partnered on a rewards card with Barclays Card, but the alliance is reportedly ending as Apple Card launches.

Apple is also seeking to make credit more transparent.

Consumers are encouraged to accrue the least amount of interest. The payment feature on the app lets consumers calculate the amount of interest that will be paid depending on what exact portion of the balance they choose to pay.

Apple has also made its card fee-free.

Following its other privacy pushes, Apple has designed its card to be secure. The Apple Card leverages features such as Face ID and Touch ID for verification.

The physical card has no numbers on it, in an effort to prevent unauthorized use if the card is stolen.

Apple Card is made is titanium. Image credit: Apple

Apple has said that it wants the card to be accessible to a wide range of its iPhone owners. But from the metal card to the connection to iPhone, the Apple Card is poised to appeal to an affluent audience, putting it head to head with other credit companies such as American Express and Luxury Card.

“Metal cards used to just be for American Express Black card holders, but they’ve since become available to a wider audience,” Ms. Rathner said. “The Chase Sapphire Preferred, Sapphire Reserve, AMEX Platinum and Capital One Venture are popular metal cards.

“There’s a certain sense of luxury and power that comes with plunking down a heavy card to pay for something, so many credit card issuers began to offer them with their more premium rewards cards,” she said. “Often those cards come with valuable benefits like sign-up bonuses, concierge service and airport lounge access.

“The Apple Card isn’t a travel card, so the metal design has more to do with Apple’s aesthetic. They make simple, beautiful products.”

Mobile payments

Aside from increased competition among credit firms, Apple Card will also usher in even more impetus for retailers to establish mobile payment options.

“Because the Apple Card earns a higher cash-back rate when you use Apple Pay, it literally pays to use your digital wallet whenever possible,” Ms. Rathner said. “This will definitely nudge cardholders toward using Apple Pay as often as they can, and increase demand for retailers to adopt this technology if they haven’t yet.”

The global mobile wallet market is expected to reach more than $3 trillion by 2022, making mobile commerce for luxury brands a highly desirable prospect in the future.

Currently, the mobile wallet market is valued at more than $500 billion and is set to grow massively over the next four years, according to a report from Zion Market Research. Luxury brands looking to capitalize on mobile commerce, particularly in China, would do well to invest in mobile wallets (see story).

Many high-end retailers have already leaned in to Apple Pay.

British childrenswear retailer Childrensalon responded to consumers’ growing use of mobile for online shopping with the introduction of Apple Pay for its Web site.

In what the ecommerce site heralded as an industry first, Childrensalon began accepting Apple Pay for Web in 2017. With luxury clients increasingly gravitating toward smaller screens, retailers are raising the chance of mobile conversions with payment solutions (see story).

“The card is mostly aimed at those who use Apple Pay,” Ms. Gonzalez said. “I expect that it will be received with more enthusiasm by the younger generations, who tend to use technology and especially smartphones for anything and everything.”

Alexa’s Echo Show 5 is designed to be put in more rooms. Image credit: Amazon

Alexa’s Echo Show 5 is designed to be put in more rooms. Image credit: Amazon

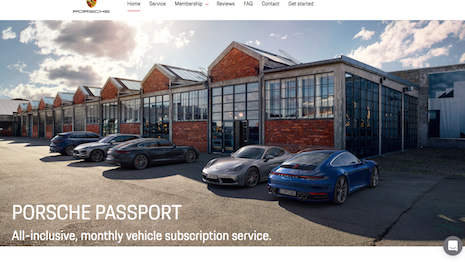

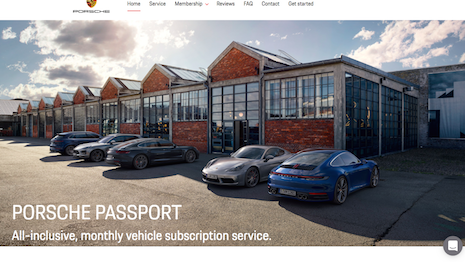

Consumers increasingly prefer experiencing ownership rather than outright possession ownership, thus birthing the subscription-based, mobile-driven rental economy for products. Image credit: Porsche

Consumers increasingly prefer experiencing ownership rather than outright possession ownership, thus birthing the subscription-based, mobile-driven rental economy for products. Image credit: Porsche