By David Friedman

Several years ago, at a luxury conference in Monaco, Richemont chairman Johann Rupert made headlines when he announced that his biggest fear was around robots.

The audience, which was filled with executives from the top luxury brands in the world, was somewhat thrown off guard as they were expecting a typical discussion around the future of luxury fashion and watches.

At the heart of Mr. Rupert’s apocalyptic keynote was the notion that with the rise of robots, there would be a fundamental shift and with it, the gradual displacement and deterioration of the middle class.

Middle class and how the optics and engagement strategies of luxury have shifted

In a world where the middle class does not exist, the polarization of wealth becomes more acute. It was that acute polarization that frightened Mr. Rupert because against that backdrop, he lamented that wealthy people would be deterred from buying Cartier watches anymore.

There is also the aspirational aspect of luxury that subconsciously buttresses the purchase as unique.

Several years ago, I recall a discussion with executives at Rolex about one of its advertisements for a watch priced around $400,000 to $500,000. After I questioned the value in such an advertisement in actually generating sales, the manager in Hong Kong remarked, “Its not to sell more watches, it’s so that everyone else knows how much it costs.”

It was about the extreme optics.

While at the time, his prophetic vision seemed a bit outlandish, I have come to appreciate his foresight.

For example, imagine a luxury buyer whose business and wealth comes primarily from trucking or logistics. Most certainly over the next five years with the rise of autonomous driving, a majority of those employees will most likely be displaced.

Under that scenario, the owner of the business is going to assume a hyper-sensitivity around the displaying and showing of wealth. Moving forward, those optics will be implanted as a key part of the luxury decision-making process.

Fast forward, and while Mr. Rupert’s apocalyptic vision has yet to unfold, we do a similar potential pattern of the economic implications facing much of the middle class.

There have been record unemployment figures. Yet, we do not have the same potential optics around the purchase, for the moment.

In some ways, COVID-19 has provided a layer of anonymity combined with the time and focus for a luxury buyer who might have been on the fence or evaluating a purchase.

Being that many people are sheltering-at-home, those luxury items that play well in terms of ecommerce are poised and experiencing growth in revenue.

COVID-19 has sowed the seeds for a potential fundamental decoupling of high-end luxury purchases from the assumed luxury experience. COVID-19 has challenged this fundamental assumption that high-end luxury purchases have to be integrated with an experiential lifestyle.

The impact has specifically predicted to be bifurcated between “soft” luxury and “hard” luxury, but the reality has been much more nuanced.

Luxury Daily ran a recent article about the growth of Range Rover sales driven by the online car configuration tools where buyers can create their own “bespoke” version (see story).

However, this is always been what the consumer wanted anyway and what marketers pray for: the ability for consumers to merge their own personal narrative with the narrative of a product, which, in this case, is a car.

There are other super car companies that have been experiencing bursts of oversubscription with their most recent launches.

Whereas typically the buyers would need to “kick the tires” or have a “test run,” the sale cycle is being truncated and done mostly virtually.

However, it remains to be seen how many of those acquisitions are by first-time buyers versus existing owners and collectors.

A key sales implication of COVID-19 has been to fundamentally shift customer touch points and engagement further up the digital or virtual customer journey. This offers both opportunities and challenges to luxury brands seeking to define and chart a strategy during this time.

In similar fashion, as legal firms and family office firms, who were the last bastions of physical meetings, vowed that they would never go fully virtual have been adapting to virtual meetings and processes at lightning speed, high-end luxury items can leverage this unique time to connect with their key clients who typically are very challenging to engage.

Best practices, strategies and tactics during COVID-19

While it makes great economic and strategic sense to be using virtual technologies to connect with key clients, especially since often their schedules are challenging, only the brands that equip their sales professionals with how to do this will be able to capture the opportunity of this moment to build and potentially deepen authentic and genuine relationships with their key prospects and VIP clients.

Luxury brands that cling to an anachronistic view that physical experiences are critical will be left behind during this period and further de-position themselves for the post-COVID-19 virtual shifting landscape.

While there might be a surge in travel and meetings as the restrictions continue to be lifted, luxury clients and everyone else will experience a fundamental reordering and prioritization of physical meetings.

Moving forward, how luxury customers spend their time in maisons and personal meetings will be highly evaluated by themselves versus doing a virtual meeting.

This shift in attitude and behavior opens opportunities both now and in the future, as well as posing some challenges for luxury brands whose sales process and customer journey has been predicated upon the assumption of providing over-the-top luxury experiences as part of the brand DNA.

Zoom and Microsoft Teams have quickly woven themselves into the culture of communication with clients and prospects and from internal operations standpoint.

Virtual client cocktails

Many luxury brands have opted for hosting “virtual cocktails” with their key clients and some specifically within a geographic area where the various consumers within that location join and bring their own craft cocktails or high-end wines.

While the virtual nature of the gathering allows for a non-geographic dynamic, having the “local” feel creates a more intimate setting in the virtual context.

That is not to say that brands should not take advantage of getting their clients together in one virtual place, regardless of time zone or geography. But in this one example it helped to create a more intimate sense of community beyond being lovers and fans of this particular luxury sports car.

Check-in and circling with VIP clients

Many brands I have spoken with recognize that this is a great time to circle with VIP clients and genuinely check in with how they are doing without the backdrop of any sales agenda.

One manager of a top luxury watch company informed me how he had given his sales team strict instructions to not sell during this period and just focus on connecting.

Since expectations around virtual meetings have shifted, any sales professional can circle with their key clients and while they may not always get the “appointment,” it will certainly not be considered out of the ordinary whereas pre-COVID-19, it might have appeared quite odd.

COVID-19 has accelerated both the internal adoption of virtual meetings from an operations standpoint, but also overflowed into opening the opportunity to scale client engagements beyond a phone call but without the cost and expense of travel.

Laying the foundation for referrals post-COVID-19

Coaching is key for how to scale referrals to new clients in a more systematic and measurable way.

Some brands are actually using this unique window to first reconnect with key clients and engage them, but also with the right customers and appropriate context, lay the foundation for asking for referrals as the dust starts to settle from the pandemic.

In some sense, they are getting permission now as part of the conversation, to circle later and ask for introductions.

In an even stronger and more bold sense, some marketers are actually asking for introductions during there Zoom meeting, depending on the level of relational capital and getting them. Consumers are working from home and many of them who are used to engagement will be bored and welcome the opportunity to connect their friends with a brand about which they are passionate.

Pre-COVID-19, luxury brands, financial services firms and nonprofits were coached to shift from “hope marketing” events into “bespoke marketing” strategies by resisting the urge to plan and invest in creating events that “could not be bought” by their wealthy clients and always ending the process by hoping their clients bring their “friends” to the event for prospecting.

Instead, “bespoke marketing” seeks to proactively leverage the relational network maps around their VIP clients to identify specific prospects with whom they would like to engage and then building a “bespoke” marketing strategy around each individual emanation from their passions, hobbies and interests.

The fundamental difference is the starting point. “Hope marketing” starts with the idea and marketing concept and ends with the question, “Who should we invite?”

While “bespoke marketing” inverts the process and starts by asking, “Who do we want to engage?” And what are their passions, hobbies and interests.

This method translates very easily to the virtual world, being that potential prospects connected to clients do not have to invest time or money on attending a virtual event.

With this blueprint, a brand can easily find an expert on a specific topic or passion to hose a virtual “salon” and leverage that event either to just deepen engagement with existing VIP clients or as a way to engage new prospects by having their existing VIP use this as a way to invite their “friends.”

But brands that implement this type of virtual strategy should take caution that they do not translate those same mistakes to their virtual marketing events.

COVID-19 HAS OFFERED a unique window where typically high-end luxury purchases and client engagement that revolved around the necessity of carefully choreographed experiential strategies have become decoupled and offer the opportunity to virtually engage directly with VIP clients as well as virtual marketing events.

David Friedman is cofounder of WealthQuotient, a New York-based data-driven, referral-based prospect development platform and former cofounder/president of Wealth-X, a company that focuses on ultra-affluent data and intelligence. Reach him at dfriedman@mywealthq.com.

The BMW Digital Key with the Apple iPhone is yet another step toward integration of mobile services with automotive technology. Image courtesy of BMW

The BMW Digital Key with the Apple iPhone is yet another step toward integration of mobile services with automotive technology. Image courtesy of BMW

Potential bidders can virtually visit Sotheby’s pre-sale exhibitions. Image courtesy of Sotheby’s

Potential bidders can virtually visit Sotheby’s pre-sale exhibitions. Image courtesy of Sotheby’s

Saks Fifth Avenue’s use of NuOrder’s cloud-based wholesale buying platform will allow for better collaboration with its vendors, drive inventory efficiency and ensure merchandise effectiveness across all touch points. Image credit: Saks Fifth Avenue, NuOrder

Saks Fifth Avenue’s use of NuOrder’s cloud-based wholesale buying platform will allow for better collaboration with its vendors, drive inventory efficiency and ensure merchandise effectiveness across all touch points. Image credit: Saks Fifth Avenue, NuOrder

Digital authentication and traceability are becoming more important as ecommerce and resale gain popularity as retail channels for luxury and fashion. Image courtesy of Arianee

Digital authentication and traceability are becoming more important as ecommerce and resale gain popularity as retail channels for luxury and fashion. Image courtesy of Arianee

The Lexus AR Play app is an augmented reality immersion into the exterior and interior features of the newly launched 2021 Lexus IS 350 sport sedan. Image courtesy of Lexus

The Lexus AR Play app is an augmented reality immersion into the exterior and interior features of the newly launched 2021 Lexus IS 350 sport sedan. Image courtesy of Lexus

David Friedman. Photo: Michael Falco

David Friedman. Photo: Michael Falco

The majestic Rolls-Royce Phantom flagship. Image courtesy of Rolls-Royce Motor Cars

The majestic Rolls-Royce Phantom flagship. Image courtesy of Rolls-Royce Motor Cars

Google’s next foray: Bringing fashion down to earth from the clouds. Image credit: Google

Google’s next foray: Bringing fashion down to earth from the clouds. Image credit: Google

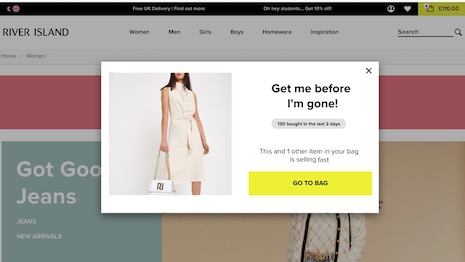

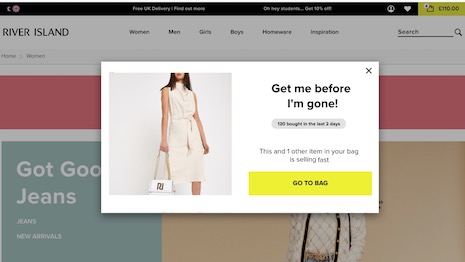

The COVID-19 lockdown has meant that digital has more say in conversion to in-store and ecommerce sales. Image courtesy of River Island, Qubit

The COVID-19 lockdown has meant that digital has more say in conversion to in-store and ecommerce sales. Image courtesy of River Island, Qubit